Financial Data for Middle School Building Projects Referendum

May 10, 2024

The Sheboygan Area School District (SASD) has a long history of fiscal responsibility and has taken excellent care of our school facilities. However, Farnsworth and Urban Middle Schools were built in the 1930s and are now approaching the time when they need extensive repairs and/or upgrades.

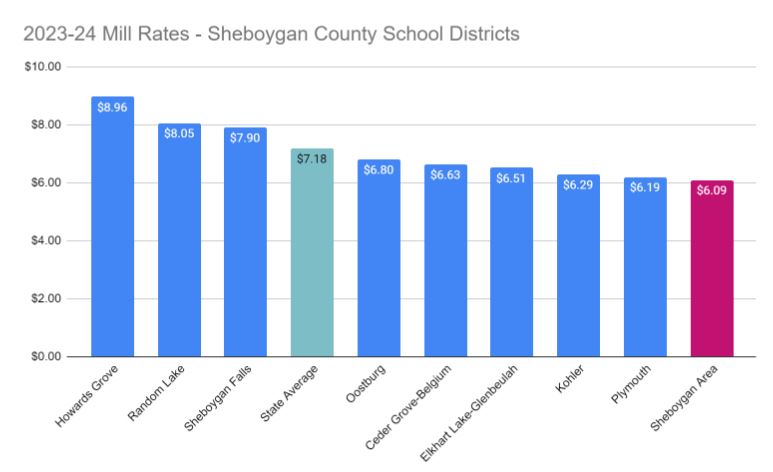

The charts below show that SASD has one of the lowest property tax mill rates when compared to other districts.

If a majority of Sheboygan voters support the referendum, the property tax mill rate would increase by $0.30.

Mill Rates for Sheboygan County School Districts

This chart illustrates the 2023-24 property tax mill rates for school districts in our geographic area.

Mill Rates for Comparable School Districts

This chart illustrates the 2023-24 property tax mill rates for comparable school districts in the state of Wisconsin.

Peer districts were selected to include those with similar enrollment levels (between 4,000 and 20,000 students) and makeup of economically disadvantaged students (45-65% of student population)

This chart illustrates the 2023-24 property tax mill rates for school districts in our geographic area.

Mill Rates for School Districts in our Athletic Conference

This chart illustrates the 2023-24 property tax mill rates for school districts in our athletic conference.

SASD Mill Rate History

The SASD mill rate has decreased for the last seven years, including an 11.6% decrease in this year’s rate. The tax rate in 2023-24 decreased to $6.09 per $1,000 of property value. (rate varies by municipality).

If a majority of voters support the referendum, the property tax mill rates would increase by $0.30 and remain below the 2023-2022 level. The gray block illustrates the estimated tax impact.

Related Articles:

SASD 2023-24 Budget Information